Picture this: You’re expecting the newest member of your family, and while you’re thrilled about the arrival of your bundle of joy, you’re also wondering how you’re going to juggle work, recovery, and bonding time. Well, ladies and gents, the Philippines has got you covered! Say hello to the Expanded Maternity Leave Law, or shall we say, your new best friend.

The 105-Day Expanded Maternity Leave Law (Republic Act 11210 or EML) enacted on March 11, 2019, is a significant stride in Philippine legislation. It grants all eligible women, irrespective of their sector of employment or civil status, a comprehensive maternity leave policy. This guide provides an easy-to-understand overview of the EML, the process of availing it, and what one should do.

Key Features of the EML

The EML has numerous features that make it distinctive:

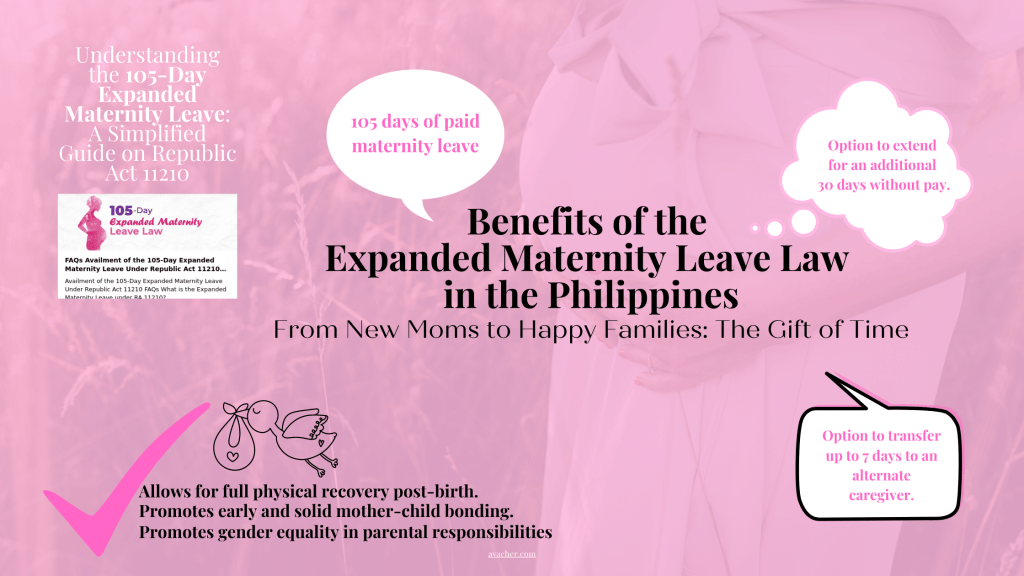

- It extends the paid maternity leave period to 105 days in the case of live birth. Women can further extend this by 30 days without pay.

- Solo parents under RA 8972 are entitled to an additional 15 days of paid maternity leave.

- In cases of miscarriage or emergency termination of pregnancy, including stillbirth, the paid maternity leave is 60 days.

- Every instance of pregnancy allows a woman to apply for maternity leave, regardless of frequency.

- For multiple childbirths, such as twins, a woman will only receive one maternity benefit.

- The maternity leave must be availed of in a continuous and uninterrupted manner, inclusive of Saturdays, Sundays, and Holidays.

- A female employee can avail of maternity leave if childbirth, miscarriage, or emergency termination of pregnancy occurs not more than 15 calendar days after the termination of her employment.

Availment of EML in Different Sectors

Private Sector, Informal Economy, and Voluntary Contributors to SSS

- Eligibility: A female member must have paid at least three monthly SSS contributions in the 12-month period preceding the semester of the birth, miscarriage, or emergency termination of pregnancy.

- Notice Requirement: The employee should notify her employer of the pregnancy and the expected date of delivery. Self-employed, voluntary, and overseas Filipino workers (OFWs) who are members of the SSS may give notice directly to the SSS.

- Manner of payment and taxability: Full payment of maternity leave benefits to qualified female workers shall be advanced by the employer. The SSS shall directly pay the maternity benefits of female members who are self-employed, including those in the informal economy, OFWs, and voluntary contributors.

Public Sector Workers

- Eligibility: Any pregnant female worker in the government service may avail of the maternity leave benefits under RA 11210.

- Notice and other requirements: The pregnant worker should notify the head of the agency of her pregnancy and the date of her maternity leave at least 30 days in advance.

- Manner of payment and taxability: A female public sector worker is entitled to full pay from her agency during her maternity leave.

Allocation of Maternity Leave Credits

A mother may allocate up to seven days of her paid maternity leave to the child’s father or an alternate caregiver. This is not applicable in cases of miscarriage or emergency termination of pregnancy, including stillbirth.

Maternity Leave Credits

The maternity leave credits can be credited as a combination of prenatal and postnatal leave as long as it does not exceed 105 days, with the compulsory postnatal leave being not less than 60 days.

Special Provisions

- In case of the female worker’s death or permanent incapacity, the balance of her maternity leave benefits, if any, shall accrue to the child’s father or the qualified alternate caregiver.

- If a woman returns to work prior to the exhaustion of her maternity leave, she will not be paid for services rendered.

- Female national athletes on the roster of the National Sports Association who becomes pregnant will receive special benefits.

Availment and Eligibility

To qualify for the maternity leave benefits, a female member must have paid at least three monthly SSS contributions in the 12-month period immediately preceding the semester of the birth, miscarriage, or emergency termination of pregnancy. This includes workers in the private sector, workers in the informal economy, and voluntary contributors to the SSS.

The employee is required to notify her employer of her pregnancy and the expected date of delivery. The employer then has the responsibility to transmit this information to the SSS. If an employee fails to notify her employer, she will still receive maternity benefits, subject to SSS guidelines. For self-employed, voluntary, and overseas Filipino workers (OFWs) who are members of the SSS, they can provide notification directly to the SSS.

Extended Maternity Leave

In case of live birth, a female worker in the private sector can opt to avail an additional 30 days of maternity leave without pay. This requires a written notice to the employer at least 45 days before the end of her paid maternity leave. If there is a medical emergency, prior notice may not be necessary, but the employer must be notified subsequently.

Manner of Payment and Taxability

The maternity leave benefits should be paid in full by the employer, who will then be reimbursed by the SSS for the applicable SSS maternity benefits. Any difference between the worker’s actual salary and the applicable SSS maternity benefits will be covered by the employer. The salary differential provided by the employer under RA 11210 is exempt from income and withholding taxes.

For self-employed members, including those in the informal economy, OFWs, and voluntary contributors, the SSS will directly pay the maternity benefits.

For Public Sector Workers

For public sector workers, regardless of employment status and length of service, maternity leave benefits under RA 11210 can be availed. The pregnant worker should notify the head of her agency about her pregnancy and the date of her maternity leave at least 30 days in advance.

In the case of live birth, female public sector workers can also avail of the additional 30 days of maternity leave without pay or use their earned sick leave credits for extended leave with pay. The payment can be made through a lump-sum payment or regular salary payment through the agency payroll. Maternity leave in the public sector is considered paid leave of absence and is subject to tax.

Maternity Leave Credits

The maternity leave credits can be used as a combination of prenatal and postnatal leave, provided it does not exceed 105 days and the compulsory postnatal leave is not less than 60 days.

Allocation of Maternity Leave Credits

In case of live birth, a female worker can allocate or transfer up to seven days of her paid maternity leave to the child’s father or an alternate caregiver. This option is not available in cases of miscarriage or emergency termination of pregnancy, including stillbirth. Written notice to both the mother and the father or alternate caregiver’s employers should be submitted to avail of the benefits.

Other Maternity Benefits

Aside from SSS and employer-provided benefits, other maternity benefits mandated by the EML are governed by the Philippine Health Insurance Corporation (PhilHealth) Circular No. 022-2014 or the “Social Health Insurance Coverage and Benefits for Women About to Give Birth”.

PhilHealth members can avail of benefits like the Maternity Care Package (MCP) if they have paid at least nine months of premium contributions within the twelve months prior to the first day of confinement.

Penalties for Violation

Employers or agencies that violate RA 11210 will be subject to fines ranging from P20,000.00 to P200,000.00 or imprisonment for at least six years and one day or up to twelve years, or both, at the discretion of the court. In addition, the responsible officials, directors, or partners who participated in or allowed the commission of the offense will be liable.

Prohibition Against Discrimination

The Expanded Maternity Leave Law provides that the use of maternity leave benefits should not be used as a basis for demotion or termination. Female employees have the right to return to the same or equivalent position, pay, and benefits after their maternity leave. Failure by an employer to comply with this provision will be liable for discrimination and penalized with a fine of not less than P20,000.00 but not more than P200,000.00, or imprisonment for not less than six years and one day but not more than twelve years, or both, at the discretion of the court.

The Expanded Maternity Leave Law is a significant development in providing more substantial benefits and protection to women in the workforce. This law not only supports the physical recovery and bonding of the mother and child but also promotes gender equality by encouraging shared parental leave responsibilities. It is crucial for women, as well as their employers, to understand these rights and benefits to ensure they are correctly applied.

As always, if there are any changes in the law, it is important to consult with a legal professional or the appropriate government agency to obtain the most accurate and up-to-date information. This summary provides a general overview of the law as of the date of writing, and specifics may vary depending on individual circumstances.

#ExpandedMaternityLeaveLaw #ParentalLeave #GenderEquality #EmployeeRights #WorkLifeBalance #Motherhood

References and Further Reading:

- Republic Act No. 11210: The Expanded Maternity Leave Law

- Implementing Rules and Regulations of the Expanded Maternity Leave Law

- Department of Labor and Employment: Labor Code of the Philippines

- Philippine Commission on Women: Gender Equality in the Philippines